Did You Know A Bad Credit Car Loan Can Improve Your Credit?

Many people assume that once they have bad credit it is almost impossible to get back into a prime credit category.

Any time you apply for a new line of credit, the lenders will take one look at your poor credit score and reject your application. It’s enough to dishearten anyone looking to better their credit history, and seems like you’ll never climb back into the 700 point range.

So how are you supposed to improve your score if you can’t get any new credit?

A bad credit car loan is actually one of the best ways to improve your credit score whilst getting you into the car you need fast. How is that possible you might ask? Let’s have a look at why taking on a bad credit car loan is you ticket to a higher score.

How is your credit score calculated?

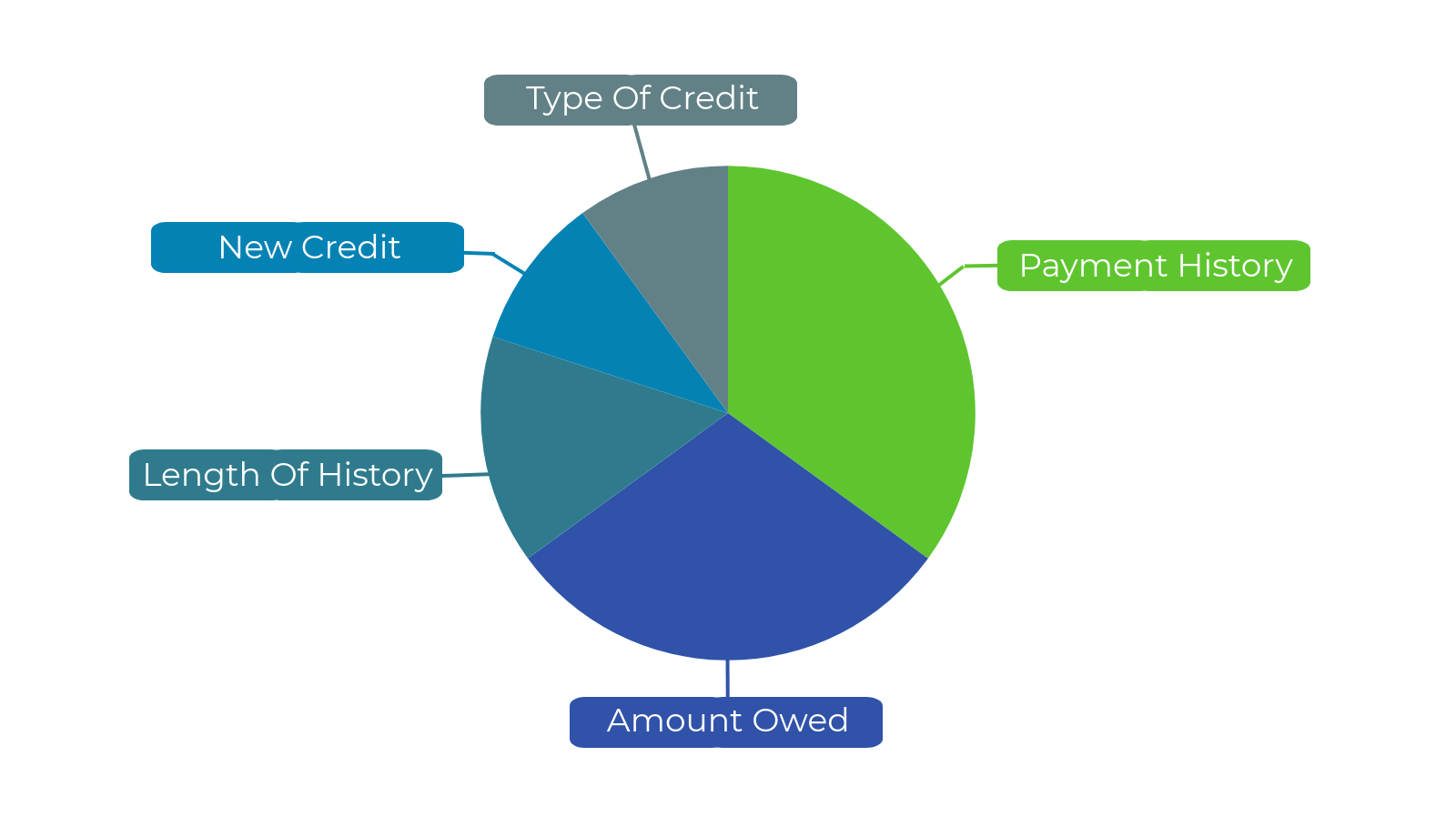

To understand how a bad credit car loan can improve your score, we first have to look at how a credit score is calculated.

Your credit score is determined by credit bureaus (Equifax and TransUnion are the main ones in Canada) and they are notoriously tight lipped on how exactly they come up with their numbers. What they have done is reveal how much they weigh each aspect of a consumer’s credit health, which ultimately influences your final score.

The factors are:

Payment History

The most important and heaviest weighted part of your credit file is your payment history. Sitting at 35% of your total score, your payment history is made up of all your past credit payments. This will include on time payments, late payments, missed payments, and defaults. Declaring bankruptcy or defaulting on a loan is the primary reason many people have bad credit and they remain on your credit file for seven years.

Amount Owed

The second most important factor at 30% is the total amount you owe to your various credit providers across all different loans. This will include any outstanding balances on credit cards, student loans, mortgages, and consumer proposals. Obviously the lower this number the better in terms of your credit score, but for longer term loans like car loans or mortgages the credit bureaus don’t hit your score too hard as they know it will take a long time to pay off.

Length of History

How long you have been a credit user is another important factor, counting for 15% of your total score. This is defined by how long ago you got your first line of credit, be it from your first cell phone plan, home internet bill or first credit card. Most Canadians will have a fairly established credit history, however, recent immigrants in Canada can struggle with this section as they did not grow up here and thus haven’t had the time to open many lines of credit.

New Credit

Making up 10% of your score will be any new credit that you have recently opened. What counts as “new” is fairly vague, but a safe guess would be any credit opened within the past six months. The general rule of thumb is to avoid applying for a lot of new credit in a short period of time, as this can indicate a risk of default to many lenders.

Type of Credit

The final 10% is determined by the type of credit you have. This one is mainly outside of your control, but is good to keep in mind anyway. It is unclear how different credit types like credit cards, mortgages and auto loans impact your score, but it is likely the larger the amount of credit taken out the bigger the negative impact on your score will be.

Credit Repair

So now that we understand roughly how your credit score is calculated, let’s take a look at how taking out a bad credit car loan can actually help you improve your credit score.

On time repayments

As we mentioned above, the single most important factor that determines your credit score is your payment history.

If you have ever missed a payment in the past, or even worse, defaulted on a loan, your credit score will have taken a pretty big hit. Conversely, when you make regular, on time payments on your lines of credit, your score improves significantly and is seen as a good sign to any lenders looking at your file.

Taking out a bad credit car loan is a great way to build up your payment history. Autoloans.ca offers the lowest interest rate car loans for customers with bad credit, and we don’t take ‘No’ for an answer when we negotiate with Canada’s largest banks. We are dedicated to getting you into a car you need at a price you’ll love, regardless of your bad credit.

Once you’ve taken out a bad credit car loan, if you continue to make your payments as agreed with your lender, these will show on your credit file. Eventually the on time payments will outweigh any previously missed payments and your score will begin to improve!

Build credit history

This one is likely of more use to new Canadians than anyone that grew up locally, but taking out a no credit car loan can be an ideal way to begin your credit history.

Many lenders will shy away from approving credit applications from people with no credit history, as they cannot get a sense of what the applicant is like as a credit user. This can be a significant barrier for recently arrived immigrants looking to get into their first car in Canada.

At Autoloans.ca we accept all applicants that do not yet have an established credit history. Our team works tirelessly to ensure you’re getting the best possible rate on your new car so that you can get out on the road and begin exploring your new home!

Once you have a car loan, your credit history will begin and then it is just a matter of time until your score is sky high and you can apply for more intensive lines of credit like a mortgage.

Beneficial credit relationships

Something that doesn’t implicitly impact your credit score but will colour any potential lender’s view of your application is the types of lenders you have received credit from in the past.

If a lender looks at your credit history and sees several credit lines from payday loan providers or unknown loan sharks they may infer that you are not good at managing your money and often run out of money before your next pay cheque.

On the other hand, if they see previous credit relationships with well known financial establishments, it’s a sign that you were approved for credit with lenders that have stricter lending criteria and so would be a good candidate for approval.

AutoLoans.ca only works with the largest Canadian banks and credit unions when we negotiate on behalf of our customers. Our bad credit car loans are backed by well established credit providers and can demonstrate to any future lenders that your application is worthy of approval.

Taking out a bad credit car loan can actually do wonders for your credit score and help you establish a solid credit history if you have recently decided to make Canada your new home.

If you are looking to get the best interest rates on a brand new or certified used car, contact AutoLoans.ca today and speak to one of our loan experts!