3 Budgeting Ideas Young Adults Should Try to Master their Money

There was a time when village elders in some parts of the world, would send boys out with bows and arrows, to kill a large animal such as a lion. It was a coming-of-age ritual.

In the 21st century, we could consider how you as a young person getting sent out into the world with almost no finance training, as a rite-of-passage of some sort.

But it often fails. Think of the mistakes you, your friends or others you’ve heard about have made with money. Sure, you learn things along the way but not without many cuts and bruises in the form of debt and frustration from not meeting your finance goals. In the end, you feel like less of an adult than you could imagine, because of these financial problems.

The good news is that you don’t need Ivy League credentials or a fraternity affiliation to learn how money works. Much of the advice needed to keep you afloat is at your fingertips. And to be clear, we’re referring to those of you in 18 – 34 year old crowd (aka “Millennials”).

Take a look at some of these ideas below.

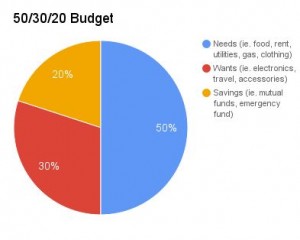

Do the 50/30/20 Split

We’ve actually covered this in a previous blog post which detailed a few budgeting hacks. But we had to reiterate this technique since we’ve noticed that it gets a ton of mentions both in cyberspace and through word-of-mouth.

If you haven’t heard of the 50/30/20 split, it works like this: your spend 50% of your take-home money on your needs, 30% on your wants and 20% on your savings.

So let’s say you bring home $40,000. You’d take 50% of that – $20,000 – and use that to pay for the essentials. That includes your utility bills, transportation costs, food and clothing.

With half of your pay left, you’d take $12,000 (30% of $40,000) to buy the stuff you want. So if you want to fly off to Italy or Australia or perhaps want to buy new gear for your band, this is the source to pull those funds from.

Finally, your remaining $8,000 – the leftover 20% of your $40,000 – goes into your savings account. And once it’s deposited, you keep the vault sealed – no exceptions.

It’s simple. Perhaps, its straightforward nature is the reason why this style of budgeting gets so much love – there’s no complex setup or knowledge needed. This is especially important for those of you who aren’t really “numbers people”, or have a lack of interest in finance.

Also, you’ll find that it builds discipline. All that’s needed for 50/30/20 to work is honesty with yourself, separating your necessities, your desires and your assets.

Tap into compounding

In banking, mentions of the word “compounding” usually brings about dreadful thoughts of interest rates and debt, but few think about compounding savings. However, your savings, just like the burdensome balance on a credit card, can compound if you put your money in the right place.

When you think about it, the idea of compounding savings is somewhat like a residual (ie. like the continuous flow of money generated by a pop star’s hit single).

Now that doesn’t mean that you can deposit $50 into your savings, expecting it to grow into a multi-million dollar fortune in 10 years (unless you’re like Warren Buffet). However, you can accrue a pretty substantial sum of money for yourself if you regularly ‘stash some cash’ into your savings account.

Rafael Pardo, professor of Law at Emory University, provides an example of compounding. In his illustration, an individual use deposits $100 per month for 40 years that yields a 5% monthly return.

Pardo points out that after 40 years, the $48,000 you put in savings will grow to a total of roughly $152,602. You can save more or less. Ultimately, the lesson remains clear – saving a little now brings big returns later.

Money Over Material

In this life, money is the foundation of our comfort.

We’re not telling you to adopt a “cash rules everything around me” mindset like the Wu-Tang clan (although the dollar dollar bills are a good motivator at times). But you should focus on your income rising faster than the costs of your lifestyle.

Here’s why: focusing too much on lifestyle as opposed to income is a precursor to debt. On paper, you could make $75,000 – a respectable income for a person of any age – and that could motivate you to spend a bit “liberally”.

Some have the tendency to spend a little more than they can afford, especially if they have credit cards. Quickly, they throw themselves in a debt hole.

However, focusing on income and increasing your earning power creates a cushion, so-to-speak. Therefore, even if you spend a bit more, you have more money to begin with, because your cash flow is larger than your expenses.

So if you’re hungry for a debt-free life, remember that an income higher than your expenses is the recipe for your goals. Doing so serves as double-duty, because it also forces you to expand your skillset at work (or else you won’t get that raise in the first place!)

A Quick Intro

It’s unfortunate that today’s schools offer little or no finance training. Today’s unstable and uncertain economy calls for “wisdom” and as a young adult, you’ll have to look around for shreds of advice.

Hopefully, the budgeting ideas made for young adults like yourself will guide you to make some smart choices (not that you already aren’t doing so) with your finances.

And as you can see, they’re not complex like the trigonometry or physics stuff you dreaded back in high school. They’re simple yet powerful strategies to understand and implement to hold onto your money.

Stay tuned for our upcoming posts as we talk more about finance for young and older adults as well.