Up for Dispute: Why You Should Fight Credit Report Errors

Imagine after years of bad credit, you’ve gotten to a point where you can refinance your auto loan.  You’ve worked hard to get here. However, after a lender pulls up your credit profile, they tell you that you don’t qualify for a better rate. How did this happen? You kept track of your expenses and bill payments – it just doesn’t add up! A loan disapproval that doesn’t add up could signal an error on your credit report, and it’s problem you would want to address sooner rather than later. If you dispute a credit error, you will save yourself from the burdens of credit dips and the hassles of lender rejection.

You’ve worked hard to get here. However, after a lender pulls up your credit profile, they tell you that you don’t qualify for a better rate. How did this happen? You kept track of your expenses and bill payments – it just doesn’t add up! A loan disapproval that doesn’t add up could signal an error on your credit report, and it’s problem you would want to address sooner rather than later. If you dispute a credit error, you will save yourself from the burdens of credit dips and the hassles of lender rejection.

What Gives?

An error on your credit report is not a random occurrence. They happen for various reasons, most of which are beyond your control (although some occur because of our own errors). Since they are handled by people and computers, mistakes are bound to occasionally happen, meaning everyday people will sometimes face problems with their credit profiles. Worse, they can affect a person who’s trying raise their credit score. Hopefully, it won’t happen to you, but at least take note of why these errors occur if you do face them.

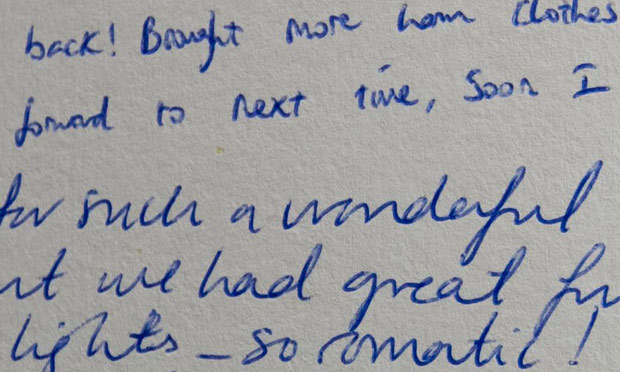

Handwriting errors

Although we live in the digital age, there’s still a need to fill out forms with regular handwriting. No one is immune to making mistakes while filling out forms. Sometimes, handwriting can get messy, making it tricky when agents need to enter information into their databases. Additionally, paper forms don’t come with the autocorrect features that some software may possess. For these reasons, inaccurate information can trickle into your credit profile and cause problems.

Mistakes made by furnishers

Not to be confused with retailers of sofas and beds, “furnishers” are companies that provide credit reporting agencies with information. Among these categories are banks, credit card companies, mortgage and auto lenders and collection agencies. Unfortunately, some of these institutions don’t have the best methods to store information, and others simply don’t know how to collect such information in a professional manner. As a result, they can make mistakes.

Not to be confused with retailers of sofas and beds, “furnishers” are companies that provide credit reporting agencies with information. Among these categories are banks, credit card companies, mortgage and auto lenders and collection agencies. Unfortunately, some of these institutions don’t have the best methods to store information, and others simply don’t know how to collect such information in a professional manner. As a result, they can make mistakes.

Credit reporting blunders

You might not want to hear this, but credit reporting agencies sometimes will get your information mixed up too. Remember, their employees are both human and machine – both of which, make mistakes. A lot of information is matched with other pieces of data, and the risk of errors occurring during the process is a reality.

Errors Likely to Taint a Credit Report

There are some errors recognized by the financial industry as quite commonplace. On a positive note, that means there’s a high probability that the mistake is one that will see a quick fix (as we’ll discuss soon). They often occur as a result of the mishaps mentioned in the previous section, or they may occur as a combination of factors.

Common Faux-pas

- Inaccurate account information – One of the most common forms of credit reporting errors is incorrect account info. That includes tiny things like misspelled names, wrong address and more serious inaccuracies, such as errors with employment information, date of birth and social insurance numbers.

- Bad debts over 7 years old – An error that can easily lead to loan disapproval is the appearance of a bad debt that’s more than 7 years old. After this time, bad debts aren’t supposed to appear on your record – credit reporting agencies must delete them from your record. But it doesn’t always happen. When it stays on record, it leads to problems.

- Debts from your ex-spouse – Joint accounts shared with a former spouse sometimes linger long after they’re supposed to. However, a divorce warrants a separation not only of wedding vows, but financial ties as well. The credit score and debts of an ex-spouse can affect your own report, and that’s why such accounts shouldn’t stick around.

- Duplicate accounts – Occasionally, someone’s credit account gets reported twice, leading to the problem of having a duplicate account. When this happens, it may seem as if you have more open credit and double the amount of debt you actually have.

How to Delete them

Now, the most important aspect of this topic is getting rid of these errors. You might not be able to prevent them, but you can certainly fix them once they surface on your radar. And the faster you can do so, the better it will be for your credit profile and your mind.

Wiping them out

- Ask for a brand new credit report directly from credit bureaus – Doing this ensures that your info is up to date, and gives you physical evidence if you plan to take things to court.

- Review the report thoroughly for errors – Errors that are both large and small can appear on a credit report, but it’s the small ones that easily go unnoticed by the eye. So review carefully.

- Circle and highlight mistakes – Pinpointing the errors found on your credit report make it easier for both you and a credit bureau to identify.

- Write a letter and mail it in – Due to a list of arbitration clauses, complaining online is not a

good way to go. Clicking “I Agree” can forfeit your right for legal action. That’s why it’s always better to send your complaint as a letter.

good way to go. Clicking “I Agree” can forfeit your right for legal action. That’s why it’s always better to send your complaint as a letter.

- Separate disputes by creating letters for each error – This may seem like strange advice, but the best way to submit a complaint, is by means of a series of letters. There’s a greater likelihood of getting each error addressed this way.

- Make sure to include evidence – If you have any means of proving these errors are wrong, make sure to keep it nearby. That way, a bureau can’t say you don’t have enough information to give.

- Make sure the data furnisher receives your dispute by mail – Institutions that fall under the data furnishing category have a legal responsibility to investigate complaints. So sending your dispute to them will almost certainly result in your errors getting addressed.

Don’t Sit on it

The lesson to learn in this post, is to never sit back and accept your credit report if it doesn’t add up. Mistakes do happen. If you know that something is wrong with your profile, there’s a good chance that you’re right. Remember, it’s your score that’s at risk here, and an error can lead to a credit decrease even if you haven’t done anything that warrants it. Follow the steps listed above to free yourself of these blunders. By taking the necessary action, you can have the confidence that errors will be corrected, and your score will remain unaffected.