What Will Your Car Loan Interest Rate be? It Depends

Drivers often feel frustrated when they don’t get an immediate answer as to how much they’ll pay in interest for their car loans.

Thanks to auto financing, the five-digit price tag on your dream car isn’t your biggest problem. It’s the interest rate you need to watch out for. Naturally, you might want to ask ahead of time what you’ll pay in interest, and if you’ve done so in the past, the answer probably was, “it depends.”

As vague as that sounds, lenders speak the truth when they utter those words. They can reveal what the interest rate on your car loan will amount to, but only after a thorough consideration of several factors.

It Takes Some Digging

When you ask a lender how much you’ll pay in interest, it’s like demanding a sports coach or personal trainer to tell you how fit you are without them assessing you. Visible abs and decent glutes alone don’t equate to elite fitness. In fact, workouts such as sprinting up hills, waving manilla ropes and a few sets of heavy squats would give the trainer a much better picture of how studly you are (or aren’t).

Before a lender can tell you your interest rate, they have to test your financial fitness by means of background checks.

Likewise, lenders need to check your financial fitness by means of a “screening” process as opposed to just looking at you. They need to put you to the test so-to-speak, uncovering details about your financial past in hopes of painting a clear picture of what your future payment habits may look like.

Of course, the patterns they see will give them an indication of the range you will land in when it comes to interest rates.

What They’re Screening – Your Financial Record

Credit score

To get one of the better interest rates for a car loan, you need a healthy credit score – there’s no getting around that. Think of it like a height requirement for a thrill ride at an amusement or theme park. If some poor kid just can’t get their head to reach the “must be this tall to ride” sign, he or she will have to stick with the “kiddie” rides.

Similarly, if your credit score doesn’t meet a certain ‘signpost’ – a particular number or range – then the car loans with the best interest rates will seem more like a pipe dream. You’ll have to go for the subprime loans, which generally carry higher rates.

The opposite is true as well. Exceed the minimum requirements, and you will have the privilege of getting approved for a car loan with the best interest rates available.

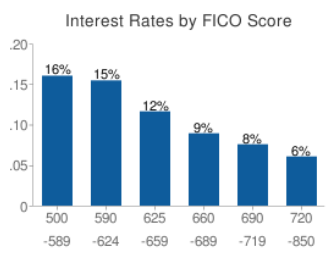

Figure 1. Interest Rates by FICO Score

Figure 1. Interest Rates by FICO Score, Copyright 2016 Bargaineering.com

Credit scores can get tricky, however, because they’re often not what we think they are. In other words, your score could be higher or it could be lower than the number or range you have in mind. And there are many reasons why we have inaccurate perceptions of our scores.

Forgotten Factors that Skew Credit Scores

- Multiple reporting agencies/bureaus (it’s common to have many credit scores)

- Shared accounts (bad credit from a spouse can affect your score)

- Errors and technicalities (wrong details on your profile can drag your score down)

Of course, you can eliminate all of those doubts by obtaining your credit report. You will get a detailed view of your score this way, and you can use it as a reference to make decisions regarding loan applications and other financial transactions.

Debt-to-income ratio

How much you make versus how much you owe also gets attention from lenders, as it is an indicator of how risky or safe you are with a loan. It’s not the same as credit. In fact, a solid credit score won’t land you a loan if your debt-to-income ratio is too high (that is the amount of debt you carry versus your actual income).

Take a look at this scenario for example.

Jack has a credit score of 700 – a good one – which he owes to regular and timely bill payments. He’s responsible with his money, resisting the urge to splurge on the 70” T.V. and home theater setup on display at Best Buy. He’s a guy you can trust to manage your money.

Except there’s one problem.

Jack’s debt-to-income ratio isn’t too great. Student loans, a divorce and an injury all took their toll on his finances, and he’s unfortunately having a bit of a struggle to shave off his debt.

Despite having healthy credit, the fact that he has more liabilities than assets suggests to lenders that he’ll have problems paying off a loan.

His finances could be stable now, but the addition of a loan could trigger a monetary mudslide that’ll drag him towards financial struggle in the near future. To avoid the risk, the lender would likely decline him from a low-interest loan (perhaps from getting a loan altogether).

The lesson here, is that the amount of debt you can carry can also bolster or hinder your odds of getting a loan.

What They’re Screening Pt. 2 – Your Choices

Whom you approach

The following statement may seem like a newsflash for you – the institution you approach can impact your car loan interest rate. That’s the reason why people get their loans from different places. It’s all about the offer, and that varies from lender to lender.

Let’s give you an example. Three people need cars – Sarah, Steve and Sally.

Sarah is a 33 year-old administrative assistant with good credit, and is in desperate need of a car – she can’t stand traffic anymore and wants to reach her kids faster. She goes directly to the bank for a loan. She walks out with a healthy 4.21% interest rate on her car loan.

Sally on the other hand is a 19 year-old university student, with virtually no credit to her name. She’s not bad with money per se, but she’s very young and hasn’t had many opportunities to build her credit. Encouraged by her dad, she goes to a used car dealership. She walks out with a 6.3% interest rate.

Steve is 56 years-old engineer, who is an automobile aficionado, and spent much of his younger years working on cars. He’s got stellar credit. And since he’s owned a few cars in his life, he knows the process of buying a car as if he were a salesperson himself. For Steve, getting a loan through a manufacturer serves him best, and he’s rewarded with a killer 1% interest rate.

What’s the difference between these drivers? Age? Career? Interests? Sure. But along with their unique circumstances, what differentiates them are the places they went to get their loans. With that said, it’s worth noting a few lessons here.

Used dealerships tend to offer a wider range of interest rates, some of which are higher than what banks or manufacturers provide.

- Banks generally offer lower interest-rates and are ideal for those with good or great credit

- Dealerships work well for all sorts of individuals, including those with poor credit, but may offer higher interest rates as well (especially in cases of bad credit and where third party lenders are involved)

- Manufacturers usually offer the best rates, and work best for those with excellent credit

The Vehicle

Closely related to the issue of whom you approach is your choice of vehicle.

The differences among cars manifest not only in their appearance and performance, but also, in their costs, interest rates included. In fact, age is a big deal. Ironically, interest rates for used vehicles exceed newer ones since it’s harder to predict the value of a car that has plenty of mileage on it. The higher interest rate covers the unknown cost of the used car’s value.

That’s why you’ve probably seen article headlines or heard people tell you the advantages of buying a new car over a used one. A lower interest rate is one of the pros. Of course, the decision to buy a new or used car should rest on many other factors, not just the potential interest rate.

The one thing that does remain constant however, is that the lender ultimately determines what your interest rates will be whether you work with them directly, the dealership or the manufacturer.

The Loan Itself Affects Your Interest Rates

The size of your down payment also determines the amount of interest you’ll pay. The amount of money you deposit initially will no doubt influence the amount of interest you pay later on.

First off, lenders take into consideration the amount of money a buyer puts towards the loan. The larger the deposit, the more likely a lender will offer a lower interest rate on a car loan as doing so suggests you can pay off the loan faster. It all boils down to the perception of risk.

And since we’re talking about down payments here, we also have to take loan duration into consideration as well. The length of a car loan affects the interest rate both directly and indirectly.

The length of a loan also has an indirect impact on interest rates as well. Typically, the rate won’t change throughout the course of a loan, unless it’s a variable rate or you refinance, but a longer term means more interest.

Figure. 2 What a Long-Term Auto Loan Would Cost You

Figure 2. What a Long-Term Auto Loan Would Cost You, Copyright 2016 Chicago Tribune

That’s why those colossal 72, 84 and 96-month car loans may seem like a godsend if you can’t make larger payments upfront or monthly. However, the interest rates slapped onto your basic payments, which you can see in the chart above, actually make the loan more costly than what you would have paid for in a shorter term.

Car Loan Interest Rates Aren’t Carved in Stone

We get it – someone telling you that they can’t tell you what you’ll pay in interest is annoying. But it’s the nature of a loan approval process. Finding your interest rate is an equation that a lender can only solve after they’ve gathered the necessary details such as your current credit score and debt-to-income ratio.

There are the other variables as well such as the car you buy, where you buy it from, and the terms of your loan. So unless you work with a genie, you couldn’t get a straight answer no matter how hard you try.

With that said, it doesn’t take high-level science to figure out your interest rate – just a bit of patience and cooperation.

If you want to buy a car and are concerned about interest rates, get in touch with us so we can help you figure it out.