It’s somewhat ironic that the welcoming of spring, where we usher in daylight savings time, say goodbye to the cruel Canada winter – particularly this…

According to CIBC’s Canadian Employment Quality Index, compiled by the bank’s deputy chief economist Benjamin Tal, job quality in Canada is at a record low,…

Did you know that, according to a new report published earlier this week by BMO Bank of Montreal, over half of all Canadians (56% to…

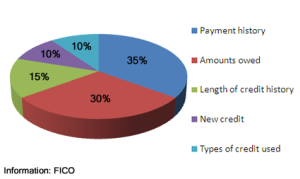

Choosing a credit card is no walk in the park, and understandably so. After all, the credit card you use has a direct influence on…

Over the last year, car loan debt has risen at significantly faster rates than normal – 20% to be exact – making it the fastest growing…

A startling new report published by Bank of Montreal reveals a few very disturbing trends about Canadians and how we manage our finances.

The Results…

Did you know, according to Bank of Montreal’s 2015 Credit Card Report, that almost half of all Canadians (46%) are currently carrying…

Each year, Readers Digest publish their Most Trusted Brand Survey, speaking to participants across Canada to decipher what brands Canadians use, and enjoy, the most….

In 2014, the average debt-to-income ratio for Canadians was $1.63.

That means that for every $1 Canadians earned, they owed $1.63 in debt, whether to…

Last week, Canadian Black Book (CBB), the largest publisher of wholesale used car prices in the country, unveiled its list of vehicles that have the…

Have you noticed that there’s a lot more flashy cars out on the roads these days? Seen more brand new Range Rovers and Audis than…

So, you’re applying for an auto loan. Well, pat yourself on the back for making it this far. But we won’t lie: applying for a…

Have you taken out an auto loan on your vehicle but are behind on the payments? Is your auto lender constantly bugging you about…

Last week, we warned our readers not to be lured by the dazzling display of vehicles and new automotive advances at the forthcoming Canadian International…

While the holiday season is far behind us, the repercussions of our December spending sprees are not. Depending on the size of your family, your…

Valentine’s Day is almost upon us, and with it, scores of advertisements promoting deals on new restaurants and appropriate venues for you to celebrate the…

At Auto Loan Solutions, Ontario’s largest auto loan company, our priority is to put you on the path towards reestablishing your credit by providing you…

Finding a shady or untrustworthy car dealer is unfortunately a stereotype that rings all too true. However, just as in any industry, consumers should not…

As the volatility of oil and gas prices continues to provide varied advantages, and disadvantages, for the average Canadian consumer, the Canadian dollar has followed suit,…

In 2013, a CIBC survey indicated that 51% of Canadian students will at one point borrow money in order to pay off their tuition fees…